The digital wealth environment in 2025 is far more complex than just a few years ago. Investors rarely limit themselves to one ecosystem anymore. Their portfolios now span centralized exchanges, DeFi protocols, hardware wallets, and even tokenized real estate or equities. NFTs and stablecoins add yet another layer. Without a premium-level solution, managing this fragmented mix risks costly errors and missed opportunities.

Case example: An experienced investor might keep ETH and BTC on Kraken, stake stablecoins on Curve, hold NFTs on Ethereum and Solana, and simultaneously manage tokenized bonds through a fintech service. Without a unified tracker, monitoring true net worth on a daily basis becomes nearly impossible.

Why serious investors ask for more than free apps

While free portfolio apps work well for beginners, advanced investors have higher demands. They require precise ROI and PnL calculations, support for both crypto and traditional assets, and reporting that meets tax and compliance standards. Free trackers rarely provide all that.

Premium platforms justify their price by delivering:

- Institutional-level accuracy in reporting.

- Broad integrations across different asset classes.

- Stronger security and compliance frameworks.

- Interfaces that stay clear and practical during volatile markets.

With portfolios becoming increasingly complex, premium dashboards are now seen as essential infrastructure, not optional extras.

“In 2025, a portfolio platform is not just a tool — it’s part of an investor’s risk management strategy.”

Key Features Characterizing High-Grade Portfolio Platforms

Premium dashboards distinguish themselves by how they handle numbers. Simply showing balances and unrealized profits isn’t enough anymore. Investors expect precise details: realized gains, cost basis reconciled across multiple exchanges, staking income, lending interest, and even minor fee adjustments. A service that miscalculates just a few transactions can lose credibility fast.

Example: An investor buys SOL on Binance, transfers it into Phantom for DeFi farming, and later swaps part into USDC on Curve. A premium tracker recalculates cost basis automatically, accounting for rewards and fees without any double-counting across wallets.

Breadth of integrations: from exchanges to banks

The line between crypto and traditional finance has blurred. Sophisticated investors now want a single interface merging digital assets with traditional accounts. Top-tier platforms connect to:

- Centralized exchanges (Binance, Coinbase, Kraken).

- DeFi protocols across multiple chains.

- NFT marketplaces for asset valuation.

- Banks and brokerage accounts for equities and bonds.

This range removes the need for multiple tools, providing one reliable view of total net worth.

Advanced security standards and compliance

Premium platforms also elevate security expectations. Non-custodial setups are the baseline, but investors now expect API key encryption, granular permission controls, and regular third-party audits. For institutions, compliance matters just as much: integrations with accounting systems and adherence to KYC/AML rules are essential.

Table: Security expectations in premium trackers (2025)

| Feature | Premium standard | Risk if missing |

| API key encryption | Local or cloud-based, audited | Exposure of trading history |

| Non-custodial setup | No withdrawal rights granted | Potential fund loss |

| Compliance integration | KYC/AML-ready reporting | Legal exposure, difficult audits |

| Uptime transparency | Public status reports | Downtime during market volatility |

Usability: professional dashboards without clutter

Professional doesn’t need to mean complicated. The best platforms combine powerful analytics with clean layouts. Dashboards are layered: quick-glance widgets for net worth and allocations, expandable sections for deeper PnL or risk analysis. This structure makes both quick checks and detailed reviews possible in the same place.

“A premium dashboard should feel as natural during a coffee break as it does during a tax audit.”

Comparative Review of Free Solutions in 2025

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

CoinDataFlow merges the power of a market data aggregator with the practicality of a professional portfolio manager. Unlike lightweight trackers, it doesn’t just fetch balances — it integrates exchange feeds, wallet addresses, and even traditional finance accounts into one synchronized dashboard. For investors managing CEX holdings, DeFi pools, and equities, this streamlined setup eliminates the hassle of juggling multiple tools.

Case example: A semi-professional trader connects Binance, Ledger, and a brokerage account. CoinDataFlow consolidates crypto holdings, tokenized ETFs, and fiat reserves in one view, updated in real time.

Transparent reporting for both traders and investors

ROI and PnL are displayed with detail: realized vs. unrealized gains, staking rewards, and yield farming returns. Reports can be exported for tax filing or compliance, with consistent cost-basis tracking across platforms.

Table: CoinDataFlow vs. Average Competitor Reporting

Balanced usability and professional-grade analytics

CoinDataFlow offers a dual-layer interface. Casual investors get quick insights like net worth, allocations, and ROI at a glance. Advanced traders and institutions can dive deeper into analytics such as volatility tracking and stress testing. This layered approach prevents clutter while keeping powerful features accessible.

Strengths:

- Unified aggregator + portfolio tool.

- Transparent ROI/PnL reporting with export options.

- Clear yet expandable interface.

- Security-first, non-custodial model.

Weaknesses (minor):

- Rich feature set may feel heavy for users seeking simplicity.

- Mobile app trails desktop version in analytical depth.

“CoinDataFlow manages to serve both the casual investor and the professional analyst without forcing compromises.”

2. DropsTab

https://dropstab.com/portfolio

DropsTab prioritizes a sleek, visually oriented interface. It appeals to investors who prefer charts, heat maps, and token graphics over traditional spreadsheets. Setting up a portfolio is simple: users just connect their wallets or exchanges, and the platform quickly generates visually attractive dashboards.

Example: A user links a MetaMask wallet and a Binance account. DropsTab instantly produces a colorful allocation chart and updates portfolio value in real time.

Limitations in institutional compliance

While DropsTab works well for visually driven users, it falls short for professional or institutional investors. Features like jurisdiction-specific tax reporting, integration with accounting tools, and advanced audit functions are missing. Casual traders may not mind, but for funds and family offices, the lack of compliance-ready exports is a serious drawback.

Table: DropsTab Overview

| Category | Strength | Weakness |

| Interface design | Visual, modern, intuitive | Prioritizes aesthetics over detail |

| Setup process | Fast and simple | Limited customization |

| Compliance & reporting | Basic ROI/PnL view | No tax-ready or institutional reporting |

| Audience fit | Retail, visually oriented users | Not aligned with professional standards |

Strengths:

- Attractive visuals with charts and heat maps.

- Simple onboarding with minimal setup.

- Works well for retail and semi-pro users.

Weaknesses:

- Missing compliance functionality.

- Reporting lacks institutional-level detail.

- Advanced users may find it too shallow.

“DropsTab feels like a polished visual snapshot — excellent for clarity, less so for compliance.”

3. 3Commas

3Commas is best known as a trading automation platform, though it also includes portfolio tracking in its toolkit. Users can set up smart bots, grid strategies, and stop-loss/take-profit rules while monitoring overall performance. For active traders, the ability to run automated strategies and track their direct effect on PnL in real time is a strong draw.

Example: A trader sets up a DCA (dollar-cost averaging) bot on Binance using 3Commas. The system executes trades automatically and updates ROI/PnL instantly within the dashboard.

Security concerns over API permissions

Despite its strengths, 3Commas raises real security concerns. To enable automation, users must provide API keys with trading permissions — not just read-only access. This increases risk, since compromised keys could allow unauthorized activity. While 3Commas has implemented safeguards, the reliance on higher-level permissions makes cautious investors uneasy.

Table: 3Commas at a glance

| Category | Strength | Weakness |

| Automation | Advanced bots and trading strategies | Requires high-permission API access |

| Portfolio | Integrated with trading tools | Secondary focus vs. automation |

| Interface | Flexible for active traders | Overwhelming for casual investors |

| Security | Safeguards in place | Risk from API permission requirements |

Strengths:

- Powerful automation and trading bot features.

- Portfolio tracking integrated into trading functions.

- Popular among high-frequency traders.

Weaknesses:

- Portfolio management is not the main priority.

- API permission requirements raise security risks.

- Interface can feel too complex for non-traders.

“3Commas excels in automation but feels less convincing as a premium portfolio dashboard.”

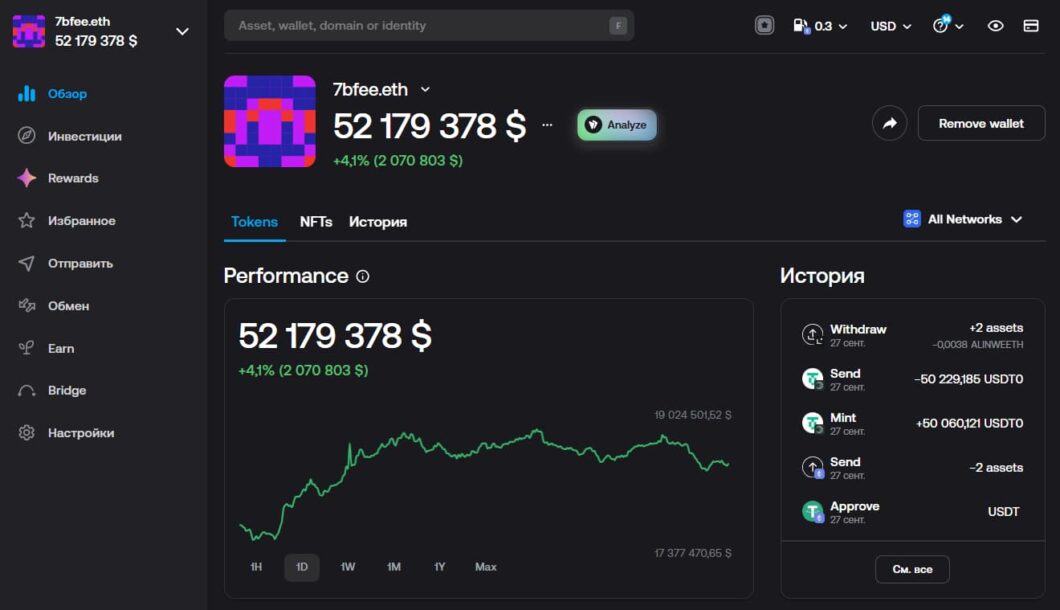

4. Zerion

Zerion built its niche as a DeFi-first platform, giving investors an easy way to manage on-chain assets. It connects wallets across multiple blockchains, letting users view liquidity pool positions, governance tokens, and NFTs in one interface. For those deeply engaged in decentralized ecosystems, it delivers a smooth and polished experience.

Example: A user connects their MetaMask wallet with assets on Ethereum and Polygon. Zerion instantly shows lending positions in Aave, liquidity on Uniswap, and governance tokens, alongside portfolio value charts.

Gaps in centralized coverage and compliance

Although Zerion shines in DeFi support, it falls short when it comes to centralized exchanges. Balances from Binance, Kraken, or Coinbase often aren’t integrated, forcing hybrid investors to use another tool. In addition, Zerion lacks advanced compliance and tax reporting features, making it less attractive for professionals who need audit-ready documentation.

Table: Zerion Overview

| Category | Strength | Weakness |

| DeFi integration | Multi-chain, wallet-native support | Limited centralized exchange coverage |

| NFT tracking | Built-in valuation and gallery | Price accuracy inconsistencies |

| Interface | Clean, user-friendly | Aimed mostly at DeFi enthusiasts |

| Compliance | — | No tax or institutional-level reporting |

Strengths:

- Robust multi-chain DeFi coverage.

- Integrated NFT portfolio management.

- Polished, easy-to-use dashboard.

Weaknesses:

- Weak centralized exchange integrations.

- No compliance or institutional reporting.

- Less suitable for hybrid investors.

“Zerion is a refined tool for DeFi natives, but less equipped for those balancing traditional or centralized holdings.”

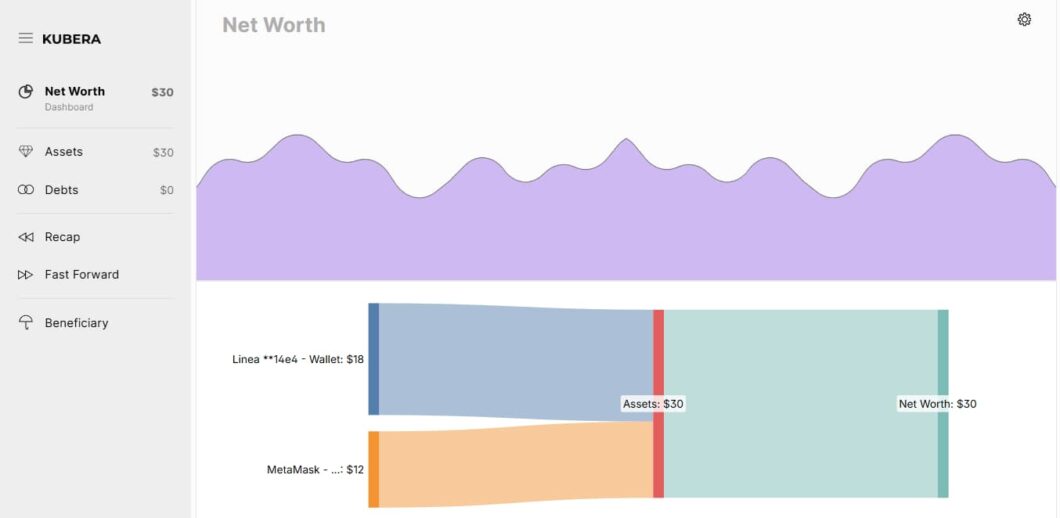

5. Kubera

Kubera is built for investors who want to track both digital and traditional assets in one place. Beyond crypto wallets and exchange accounts, it also supports bank accounts, stock portfolios, real estate valuations, and even collectibles. This hybrid model appeals to family offices and individuals who view crypto as just one part of their total wealth.

Example: A user connects their Coinbase account, a Fidelity brokerage account, and property valuations via third-party APIs. Kubera consolidates all this into one dashboard, showing crypto, equities, and real estate in a single balance sheet.

Pricing model and limited crypto-native depth

While Kubera’s scope is broad, it operates on a premium subscription model that may feel costly compared to crypto-only dashboards. Its crypto-specific features — such as detailed ROI/PnL, DeFi integrations, or NFT valuation — are relatively limited. Kubera is more of a general wealth tracker than a specialized crypto analytics platform.

Table: Kubera at a glance

| Category | Strength | Weakness |

| Asset coverage | Crypto, stocks, banks, real estate | Crypto analytics less developed |

| Usability | Clean interface, professional design | Missing DeFi/NFT integrations |

| Target audience | Family offices, hybrid investors | Less suitable for crypto-native users |

| Pricing | Premium subscription | Higher cost vs. focused trackers |

Strengths:

- Broad coverage across multiple asset categories.

- Professional design tailored for wealth management.

- Useful for diversified investor portfolios.

Weaknesses:

- Limited crypto-specific analytics depth.

- Weak support for DeFi and NFTs.

- Premium pricing limits accessibility.

“Kubera is more of a wealth dashboard than a crypto tracker — perfect for hybrids, less so for Web3 purists.”

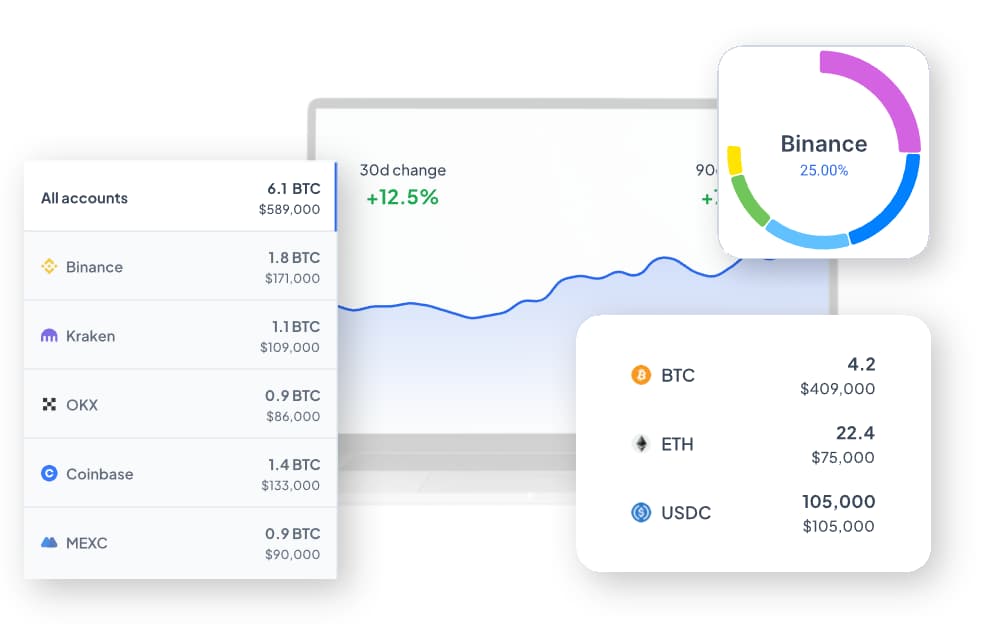

6. Altrady

https://www.altrady.com/features/crypto-portfolio

Altrady is aimed at active traders rather than casual investors. It provides multi-exchange terminals that let users trade across Binance, Kraken, KuCoin, and others without leaving the platform. Features like smart trading, real-time alerts, and advanced order types make it appealing to traders who demand precision.

Example: A professional day trader manages accounts on three exchanges at once. Using Altrady’s unified terminal, they can set stop-losses and take-profits in real time, avoiding the need to switch between platforms.

Steep learning curve for non-traders

While powerful, Altrady can overwhelm newcomers. The interface is heavily tilted toward trading tools, leaving ROI/PnL tracking as a secondary feature. It also has limited DeFi and NFT integration, and effective use of the dashboard requires both time and experience.

Table: Altrady strengths and weaknesses

| Category | Strength | Weakness |

| Trading tools | Multi-exchange terminal with smart orders | Complex interface for casual users |

| Portfolio | Integrated tracking | Lacks DeFi/NFT coverage |

| Target audience | Professional traders | Less suitable for long-term investors |

| Usability | Highly customizable | Requires learning and setup effort |

Strengths:

- Multi-exchange trading in one dashboard.

- Advanced order types and alerts.

- Tailored for professional use.

Weaknesses:

- Steep learning curve for newcomers.

- Minimal support for DeFi and NFTs.

- Portfolio tracking feels secondary to trading.

“Altrady is a trader’s cockpit — powerful at full speed, but intimidating for casual pilots.”

7. Copper

Copper is built for institutions, providing advanced custody solutions, multi-party computation (MPC) wallets, and compliance integrations. Its ClearLoop technology allows secure trading without moving assets between exchanges, minimizing counterparty risk. For hedge funds, family offices, and custodians, these capabilities are essential.

Example: A fund manager uses Copper’s custody service to securely hold client BTC while executing trades across several exchanges through ClearLoop. Assets never leave the custody environment, meeting both security and compliance standards.

Unsuitable for retail users due to cost and complexity

Although Copper excels in institutional-grade security, it is priced and structured for enterprises. Retail investors generally find it inaccessible, both financially and technically. Compliance audits, enterprise key management, and regulatory frameworks add value for funds but overwhelm individuals seeking only simple tracking.

Table: Copper at a glance

| Category | Strength | Weakness |

| Custody | Secure MPC wallets, ClearLoop trading | Too complex for retail investors |

| Compliance | Full audit trails, regulatory alignment | Not relevant to typical retail traders |

| Pricing | Institutional-only contracts | Excludes individuals |

| Usability | Enterprise-focused dashboards | Not user-friendly for non-professionals |

Strengths:

- Industry-leading custody and security.

- Tailored for funds, custodians, and institutional players.

- Strong compliance and regulatory integration.

Weaknesses:

- Inaccessible to retail investors.

- Complicated onboarding and pricing.

- Not designed as a general-purpose tracker.

“Copper delivers unmatched institutional security, but it’s far from a retail-friendly dashboard.”

What the Comparison Reveals

Despite different areas of focus, top-tier platforms share some consistent traits:

- Institutional-level reporting: Most now include ROI/PnL tracking with at least some tax-ready functions.

- Security-first design: Non-custodial connections, encryption, and uptime transparency have become standard.

- Wide integrations: From CEX to DeFi and NFTs, broad coverage is no longer a niche — it’s expected.

- Professional dashboards: Even visually driven platforms like DropsTab have shifted toward cleaner designs with layered analytics.

These shared traits highlight how much the market has matured: what was once “advanced” is now the baseline.

Where many still fall short (usability, compliance, pricing)

Even premium services have gaps that limit their adoption:

- Usability barriers: Platforms like Altrady and 3Commas overwhelm newcomers with trading-heavy features.

- Compliance weaknesses: DeFi-first tools such as Zerion lack institutional-grade reporting.

- Pricing hurdles: Kubera and Copper exclude individuals through high subscription costs or enterprise-only models.

- Integration blind spots: Zapper and DropsTab still struggle to merge centralized and decentralized holdings smoothly.

Table: Key gaps in premium platforms (2025)

| Platform | Main Strength | Main Weakness |

| CoinDataFlow | Balanced integration + clarity | Slightly heavy for minimalists |

| DropsTab | Visual clarity | Missing compliance depth |

| 3Commas | Automation + bots | Risk from API permissions |

| Zerion | DeFi dashboard + NFT tracking | Weak centralized exchange support |

| Kubera | Hybrid wealth tracking | Pricey, limited crypto-native features |

| Altrady | Multi-exchange trading power | Complex for non-traders |

| Copper | Institutional custody + compliance | Inaccessible for retail users |

Why some platforms feel more balanced for pros and semi-pros

Looking across the field, a few platforms strike a stronger balance. They deliver advanced ROI/PnL analytics, broad integrations, and compliance-ready reporting, while remaining accessible enough for semi-professional investors. CoinDataFlow especially stands out — offering the depth serious investors need without the complexity or enterprise-level pricing that pushes others out of reach.

“The best platforms are those that provide professional-grade reliability without pricing out or overwhelming semi-professional investors.”

FAQ

Do serious investors really need premium portfolio platforms?

Yes — for complex portfolios, premium platforms save both time and risk. They consolidate exchanges, wallets, and even traditional assets into one reliable view, while also providing compliance and tax reporting that free trackers usually lack.

How do premium tools differ from free trackers?

Free apps give only the basics — balances and simple charts. Premium platforms add:

- Institutional-grade ROI and PnL calculations.

- Multi-chain, multi-exchange integrations.

- Compliance-ready export options.

- Enhanced security features such as read-only APIs and encryption.

Which premium solutions cover both crypto and traditional finance?

Kubera and CoinDataFlow are hybrid dashboards. Kubera leans toward broad wealth management, while CoinDataFlow integrates both crypto and traditional accounts without sacrificing reporting detail.

How secure are API connections in these services?

Reputable platforms only ask for read-only API keys, which block withdrawals or trades. Many also encrypt credentials and provide uptime transparency. Risk arises when a platform requires trading permissions without clear reason — typical of automation-heavy tools.

What new premium features appeared in 2025?

- AI-driven insights for diversification strategies.

- Cross-chain coverage as a standard, not a paid add-on.

- Integrated DeFi and NFT valuation tools.

- Compliance bridges connecting directly with accounting and ERP systems.

Are institutional tools relevant for individuals?

Generally, no. Platforms like Copper or Lukka are built for funds, custodians, and enterprises with strict regulatory needs. For retail users, these services are usually too expensive and overly complex compared to retail-focused dashboards.

By 2025, managing a crypto portfolio has become much more complex than in the early trading years. Investors now juggle assets across centralized exchanges, multiple blockchains, DeFi protocols, NFTs, and in some cases even traditional accounts. Free trackers can give a snapshot, but they lack the depth and reliability that serious investors require.

Premium platforms step in to cover this gap, delivering institutional-grade precision, broader integrations, and compliance-ready reporting. Still, the review shows that many fall short in key areas. Some emphasize automation but compromise on security, others focus on DeFi while neglecting centralized exchanges, and institutional-grade platforms often price out individual users.

The best-balanced platforms combine clarity, breadth, and security without overwhelming the user. For semi-professional traders and long-term investors, this balance transforms a dashboard from a simple viewer into a true management tool. CoinDataFlow demonstrates how to achieve this — offering professional analytics with user-friendly design, all while remaining accessible.

“Premium doesn’t mean overcomplicated — the best platforms make professional management practical.”